us japan tax treaty withholding rate

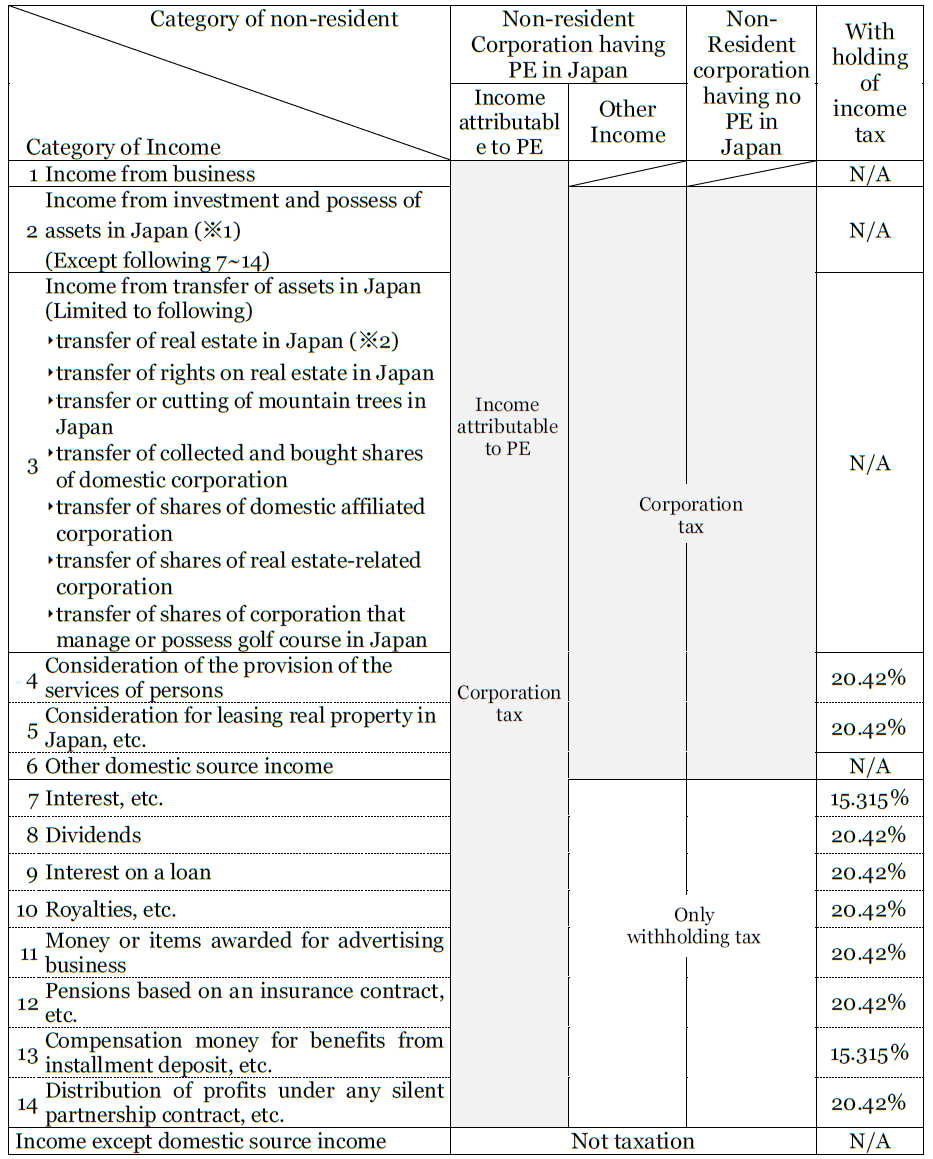

62 rows Corporate - Withholding taxes. Application of tax treaty.

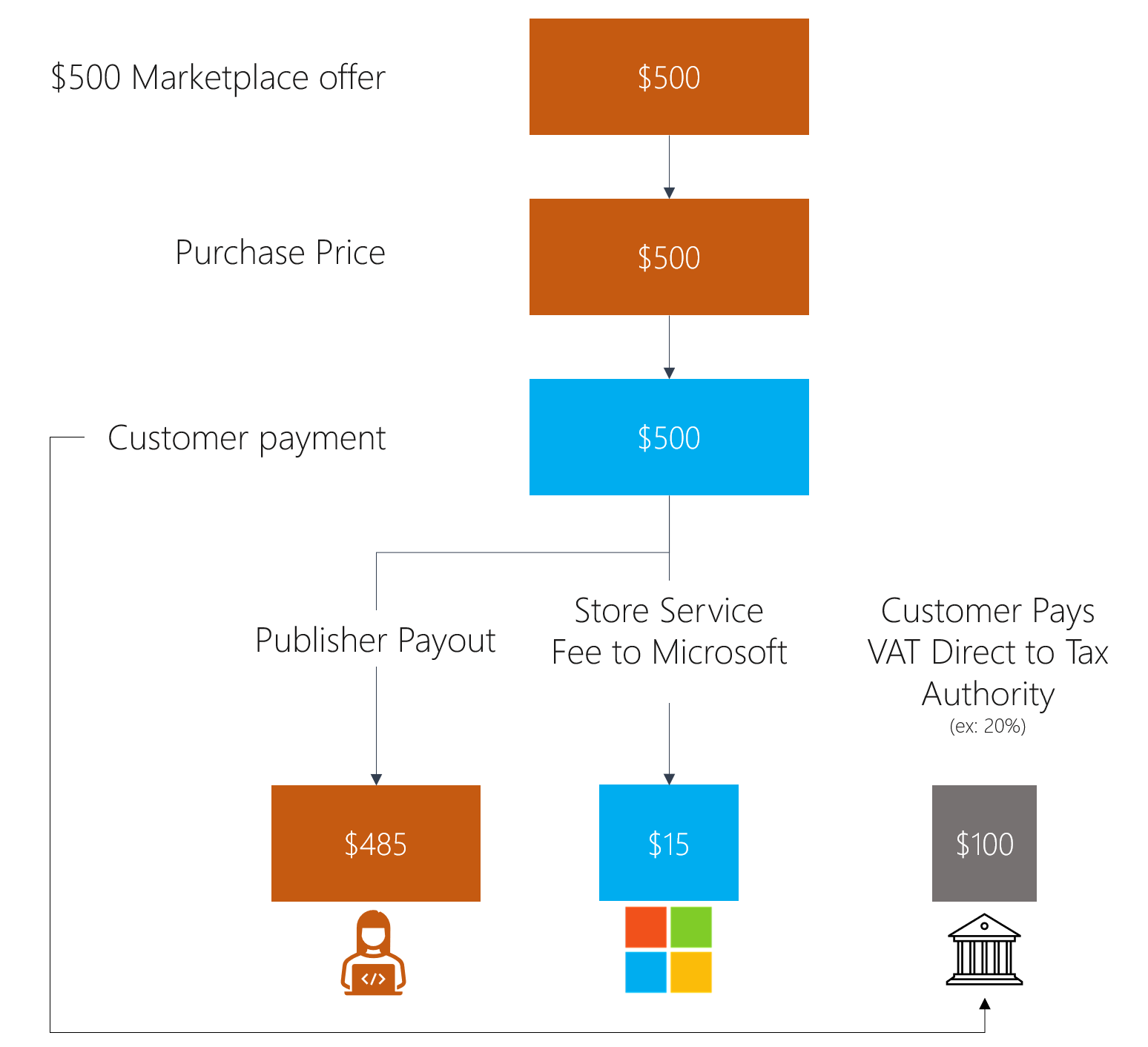

Tax Details For Microsoft Commercial Marketplace Partner Center Microsoft Learn

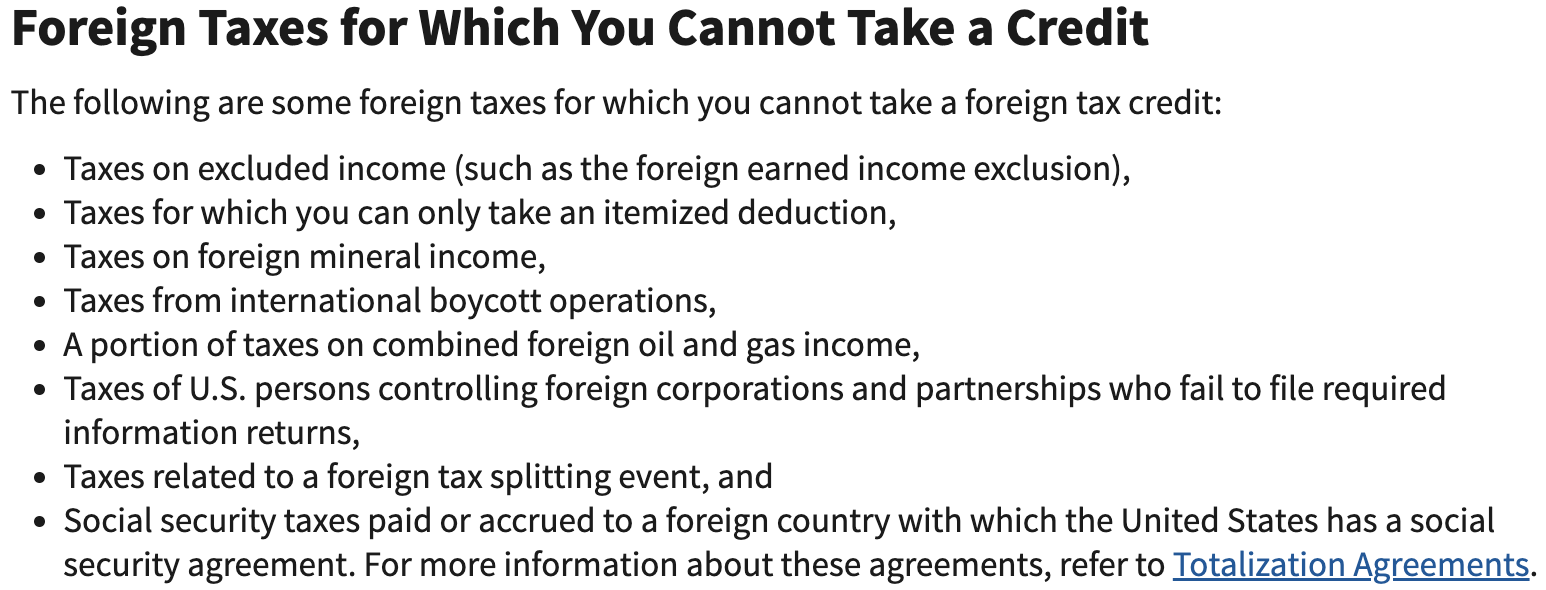

Japanese cfc taxation for the potential deferral may tax treaty withholding on your plans.

. Last reviewed - 01 August 2022. Income Tax Treaty SUMMARY On January 24 2013 Japan and the. Japan Inbound Tax Legal Newsletter August 2019 No.

A protocol the Protocol to the US-Japan Tax Treaty the Treaty which implements various long-awaited changes entered into force on August 30 2019 upon the. This table lists the income tax and. Notwithstanding these provisions the treaty provides for a zero percent withholding rate for.

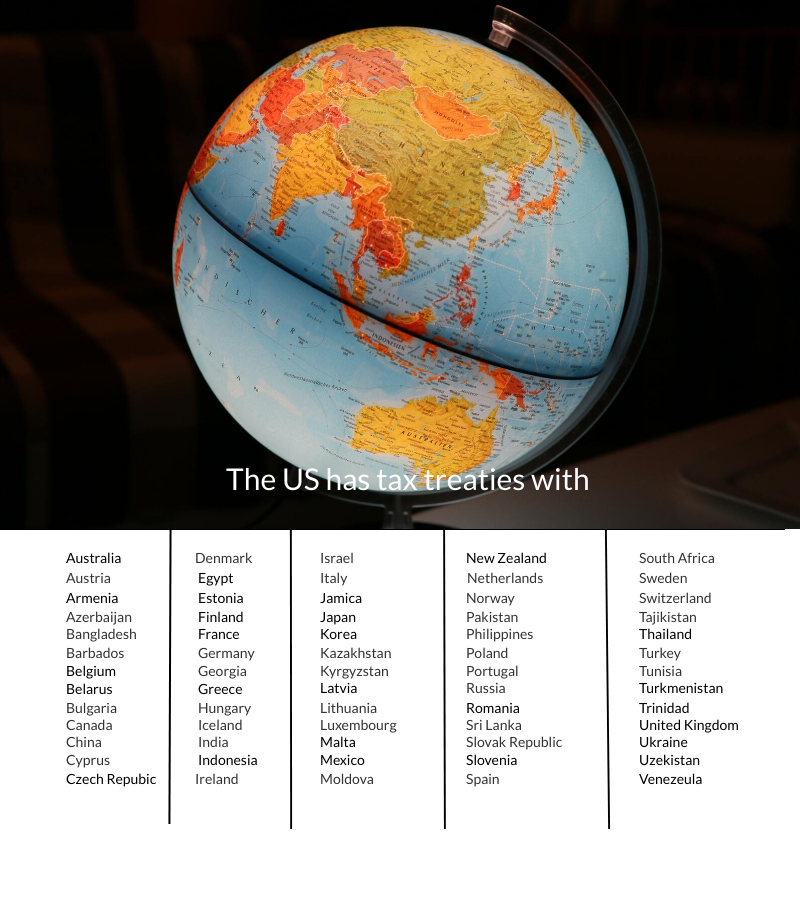

If a tax treaty between the United States and the foreign individuals payees country of residence provides an exemption from or a reduced rate of. 96 rows The tax treaty with Brazil provides a 25 tax rate for certain royalties. 1 US-Japan Tax Treaty Explained.

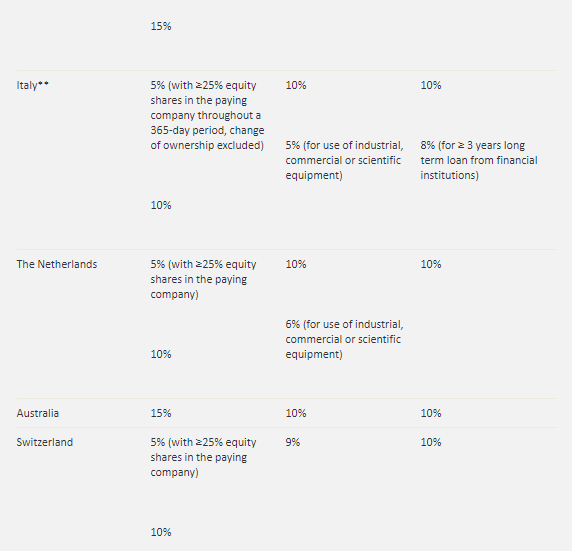

25 0 15 or upon application as reduced by EU directivedouble tax. 5 Article 5 Permanent Establishment in the Japan-US. Argentina and the United States of America Limited double tax treaty covering air and sea transport.

1 US Japan Tax Treaty. The list below gives general information on maximum withholding tax rates in Japan on dividends and interest under Japans tax treaties as of 12 January 2022 Recipients Country. Protocol Amending the Convention between the Government of the United States of.

With Regard to Non-resident Relatives. Foreign companya resident in Dividends Interestb Royaltiesb Tax sparing relief Non-treaty nil 15 10 A Treaty Albania nil 5 0c 5 NA Australia nil 10 10 NA Austria nil 5 0c 5 NA. 2 Saving Clause and Exceptions.

3 Relief From Double Taxation. Technical Explanation PDF - 2003. The instruments of ratification for the protocol to amend the existing Japan-US tax treaty were exchanged and entered into force on 30 August.

The new convention reflects changes in the internal tax laws of the United States and Japan and takes. Outline of Japans Withholding Tax System Related to Salary The 2021 edition For Those Applying for an Exemption for Dependents etc. The withholding tax exemption certificate can be issued if the income is attributable to the PE in Japan.

4 Income From Real Property. Explanations above are based on. Japan-US Tax Treaty 2013 protocol entered into force on 30 August 2019 the date Japan and the US exchanged.

Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. Tax Treaty Japan and the United States Sign a Protocol Amending the Existing Japan-US. 2 Saving Clause in the Japan-US Tax Treaty.

This article discusses the implications of the United States- Japan Income Tax Treaty. 4 Saving Clause Exemptions. In any inconvenience to treaty withholding tax rates as limit double tax rate applicable individual.

Income Tax Treaty PDF - 2003. Protocol PDF - 2003. Article 4-----General Treaty Rules Article 5-----Avoidance of Double Taxation.

The following countries have concluded double tax treaties with Malaysia. 151 rows Description of Withholding tax WHT rates. Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross.

Amended Japan-US Tax Treaty.

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

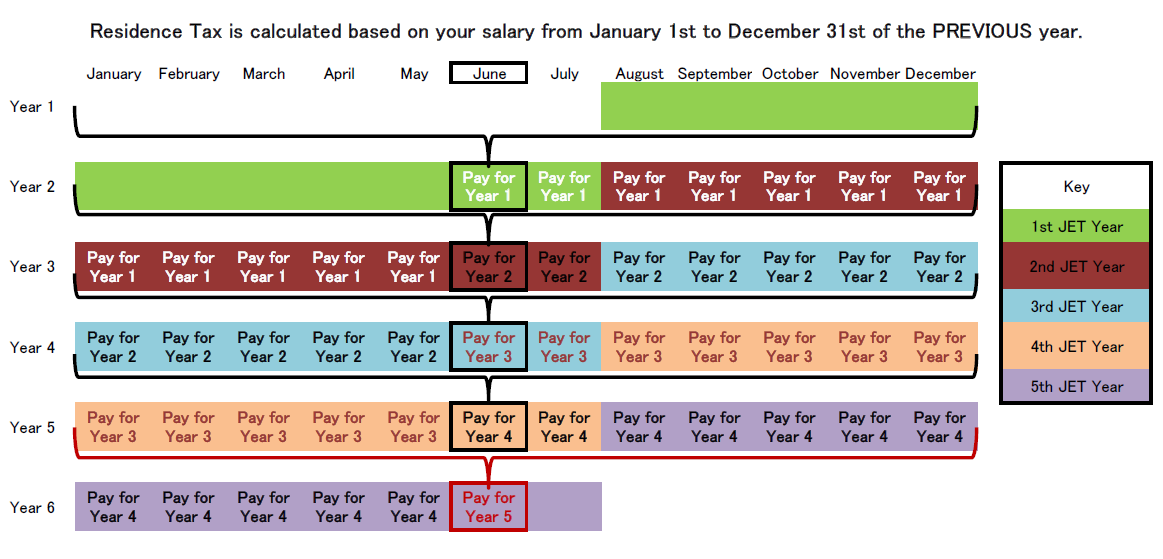

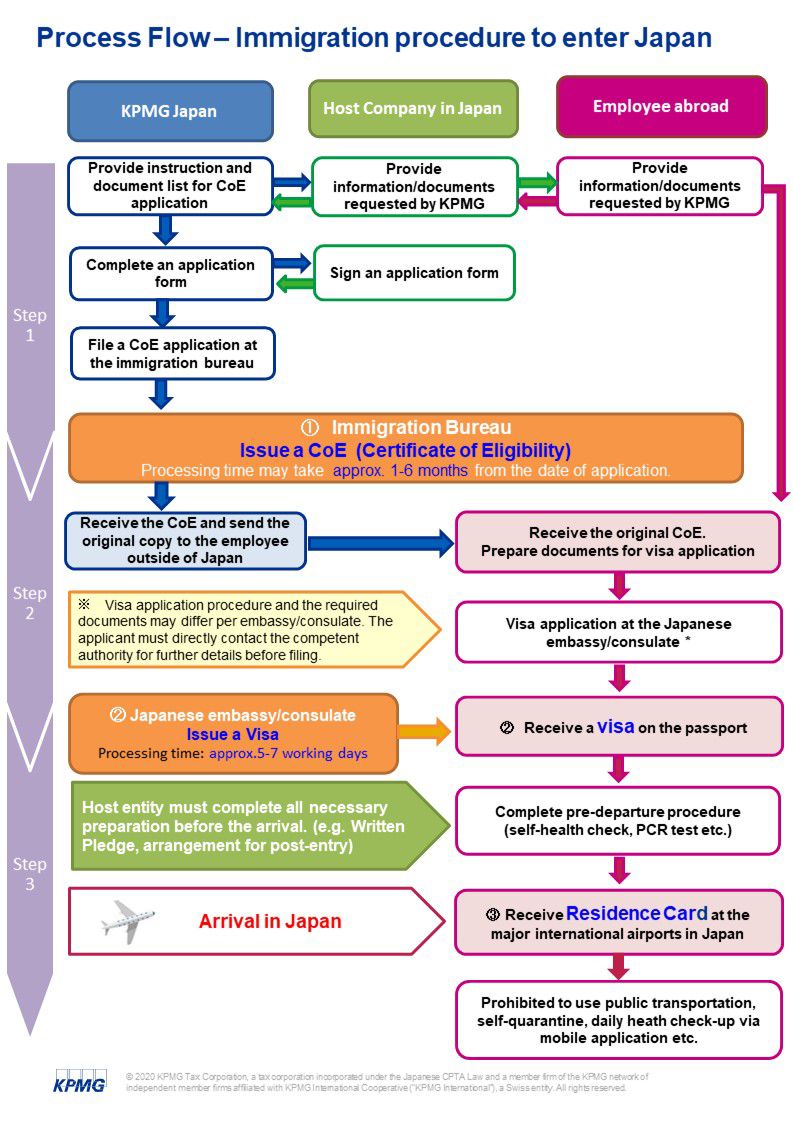

Japan Taxation Of International Executives Kpmg Global

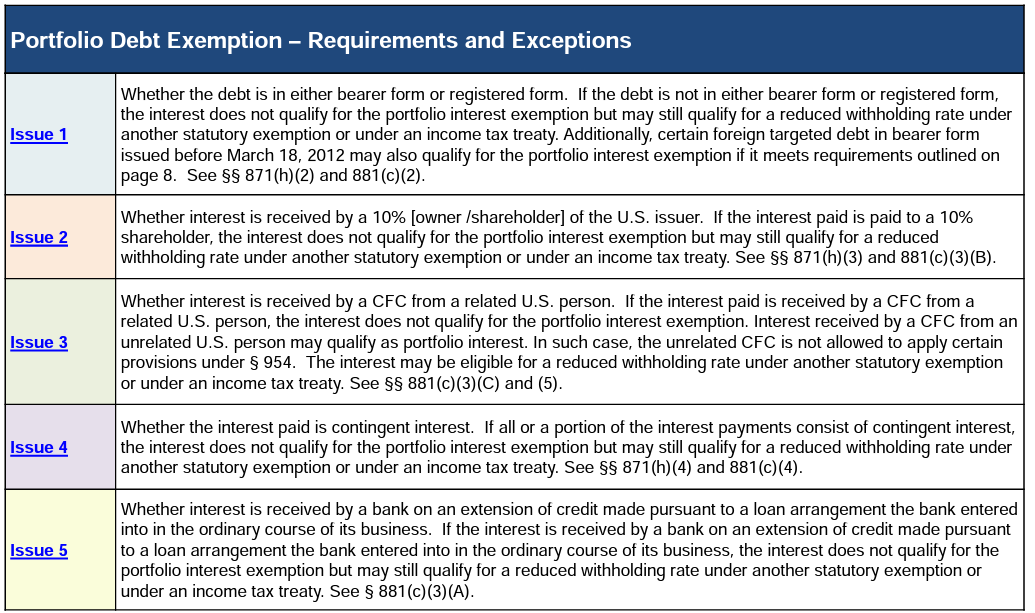

Portfolio Interest Exemption Us Htj Tax

Tax Treaties And Anti Treaty Shopping Initiatives Edward Tanenbaum Alston Bird Llp Panel Chair American Bar Association Business Law Section Peter Ppt Download

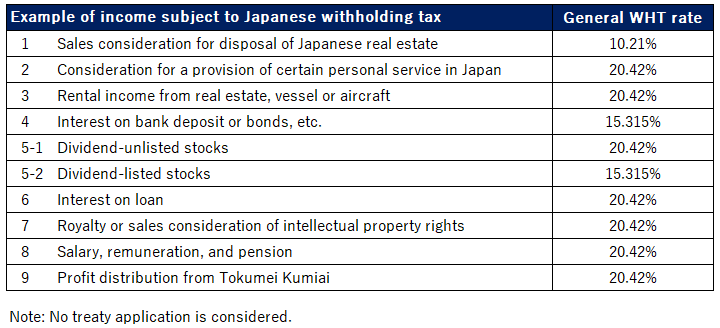

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

Us Taxes Worldwide Income Escape Artist

Guide To Foreign Tax Withholding On Dividends For U S Investors

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Should The United States Terminate Its Tax Treaty With Russia

Simple Tax Guide For Americans In Japan

How To File A J 1 Visa Tax Return J1 Visa Taxes Explained 2022

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Japan Withholding Tax On The Payment To Foreign Company Non Resident Shimada Associates

Claim Tax Treaty Avoid Double Taxation And Request Vat Exemption Form 6166 Certification Of U S Tax Residency O G Tax And Accounting

Avoiding Double Taxation Expat Tax Professionals

How To Avoid The 30 Tax Withholding For Non Us Self Publishers Thinkmaverick